The financial industry is undergoing a dramatic transformation, driven by groundbreaking innovations. Innovative banking software solutions are at the forefront of this revolution, empowering institutions to optimize operations and deliver intuitive customer experiences. From machine intelligence-powered analytics to blockchain-based trust, these cutting-edge solutions are disrupting the way financial services are conducted.

- Cloud-based banking platforms enable secure and accessible access to financial products from anywhere at any time.

- Personalized customer experiences are becoming the norm, with software solutions utilizing data insights to anticipate individual needs and requirements.

- Real-time transaction processing and fraud detection are paramount in today's fast-paced global landscape, and innovative software solutions are playing a crucial role in ensuring safety and trust.

Fueling Digital Transformation: Custom-Built Banking App Development

In today's rapidly evolving financial landscape, banks are urgently seeking innovative ways to streamline customer experience and remain competitive. A powerful tool in this endeavor is the development of custom-built banking apps. These applications empower financial institutions to provide a intuitive and customized experience to their customers, fostering loyalty and boosting Next-gen banking solution development business growth.

By leveraging the advanced technologies, custom-built banking apps can integrate with various financial services, allowing customers to control their accounts, execute transactions, and access investment advice on the go.

Optimizing Processes: Core Banking System Solutions

In the dynamic financial landscape, credit unions constantly aim to optimize operational efficiency. A core banking solution software offers a centralized platform that integrates crucial banking processes, hence empowering institutions to perform effectively.

- Moreover, core banking software employs cutting-edge systems to ensure robust protection for sensitive client data.

- Consequently, institutions can focus their resources on developing customer connections and boosting growth.

Secure Your Financial Future with Innovative Tech

In today's dynamic financial landscape, banks must integrate digital solutions to prosper. Conventional banking methods are no longer sufficient to meet the complex needs of modern customers. To stay ahead, financial institutions must deploy cutting-edge digital technologies that optimize the banking experience.

- Exploiting cloud computing provides flexibility.

- Remote banking solutions empower customers with accessibility.

- Artificial intelligence can simplify processes, boosting efficiency.

Customer insights provide actionable information to personalize banking services.With embracing these digital solutions, banks can secure their success in a rapidly changing world.

The Future of Finance: Crafting Robust and Adaptive Banking Solutions

The banking sector is undergoing a radical transformation, driven by technological advancements and evolving customer expectations. Next-generation banking demands agile solutions that can seamlessly integrate with modern lifestyles. Custom applications are playing a pivotal role in this evolution, empowering financial institutions to provide tailored experiences and enhance operational efficiency.

To succeed in this competitive landscape, banks must prioritize security and scalability when constructing custom apps. Robust security measures are paramount to safeguarding sensitive customer data from cyber threats. Scalability ensures that applications can handle a surge in users without compromising performance or reliability.

- Furthermore, next-gen banking apps should offer a seamless and intuitive user experience.

- They must leverage the power of artificial intelligence to provide personalized insights.

- Finally, the development of secure and scalable custom applications is essential for banks to thrive in the dynamic world of next-gen banking.

Modern Banking Software

In today's dynamic financial landscape, institutions must aim to maintain a competitive edge. The answer to this challenge resides with the adoption of powerful modern banking software solutions. These tools are designed to enhance critical operations, boosting efficiency and ultimately enhancing the overall customer experience.

From automated transaction processing to in-depth financial reporting, modern banking software empowers institutions to operate at their peak.

Furthermore, these solutions often integrate with advanced technologies such as artificial intelligence and machine learning, allowing for enhanced levels of personalization and customer service. By adopting modern banking software, financial institutions can set themselves apart for success in the contemporary market.

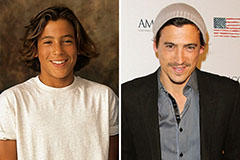

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!